Ready to File 990-T Form with our software?

Why do Exempt Organizations are required to File 990-T?

QOrganizations that are recognized as tax-exempt may still be liable for tax on their unrelated business income. This income commonly comes from a trade or business, regularly carried on, that is not substantially related to the charitable, educational, or other purposes that are the basis of the organization's exempt status.

So, if an exempt organization has $1,000 or more of gross income from all the unrelated businesses for the tax year, then it is required to file Form 990-T to report Unrelated business taxable income to the IRS.

Visit https://www.expresstaxexempt.com/e-file-form-990-t/ to file 990-T.

What is Form 990-T, and who needs to file it?

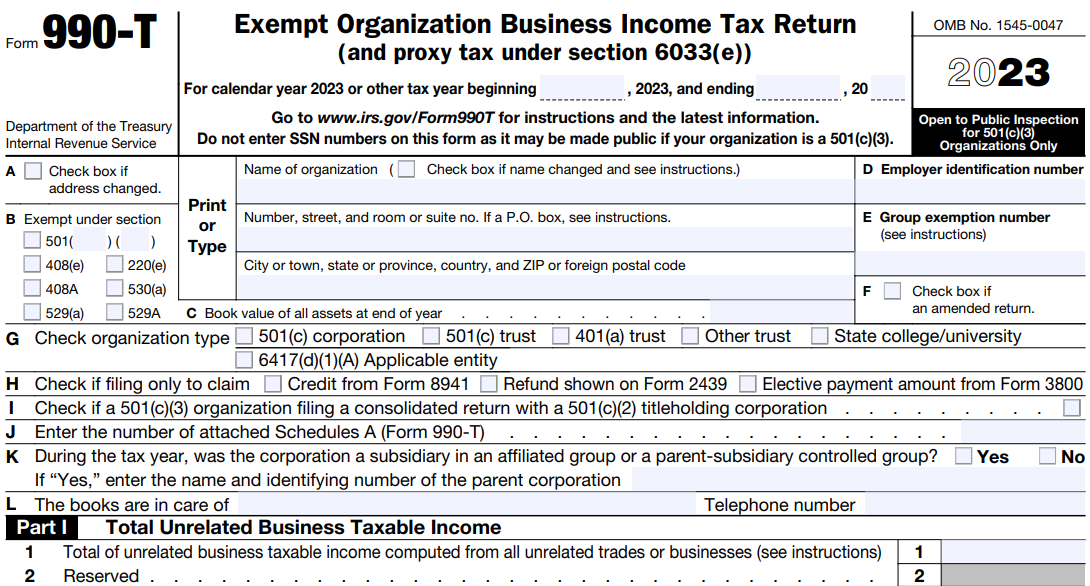

QForm 990-T Exempt Organization Business Income Tax Return (and Proxy Tax Under Section 6033(e)), is an information return used to report unrelated business income and tax liabilities.

Click here, to know more about Form 990-T Unrelated Business Taxable income.

Form 990-T is also used for the following purposes:

- To claim a refund on an income tax paid by a Regulated Investment Company (RIC) or a Real Estate Investment Trust (REIT) on an undistributed long-term capital gain.

- To request credits for certain federal excise taxes paid or for small employer health insurance premiums paid.

- To report unrelated business income tax on reinsurance entities.

Exempt organizations that file Form 990, 990-EZ, or 990-PF and have a gross income of $1,000 or more from unrelated businesses for the tax year must complete and file

Form 990-T.

To know more, https://www.expresstaxexempt.com/form-990-t/what-is-form-990-t/.

Filing methods available to file Form 990-T

QForm 990-T can be filed through Electronic or Paper Filing.

However, the IRS recommends that every exempt organization file their 990-T electronically for faster processing and instantly know the filing status.

What’s New: The Taxpayer First Act of 2019 (Pub. L. 116-25) mandated electronic filing for Form 990-T. Starting in February 2023, Form 990-T must be e-filed.

Effective in 2023, all organizations with a due date on or after April 15, must electronically file their IRS Form 990-T for 2023.

However, there is a limited exception for 2022 Form 990-T returns submitted on paper and postmarked on or before March 15.

Also, in cases where filing a paper return is permitted, such as amended returns prior to the period electronic returns were required, you can complete your 990-T form and all other required attachments to the mailing address mentioned below.

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0027

File990t.com - The Best Solution to File 990-T Forms Online

QFile990t.com is a cloud-based e-filing software trusted by thousands of exempt organizations to file

their 990-T.

Our software provides an easy-to-use interface to file Form 990-T electronically With our step-by-step filing process, preparing and transmitting your Form 990-T is simple.

- If your 990-T return gets rejected by the IRS for any reason, we guide you to correct it and help you retransmit it for FREE.

- If you have noticed any errors on your 990-T return after transmitting it to the IRS, you can always amend the return using our software.

Form 990-T filing requirements

QForm 990-T is not a mandatory submission to the IRS. Only exempt organizations with $1,000 or more gross income from an unrelated business must file Form 990-T. The organization must pay an estimated tax if it expects its tax amount to be $500 or more for the tax year.

The obligation to file Form 990-T is in addition to the obligation to file the annual information return, Form 990, 990-EZ, or 990-PF.

How to File 990-T Form with file990t.com?

QTo e-file Form 990-T get started with file990t and follow these simple steps:

- Signup For An Account

- Enter your EIN and search for your organization’s details.

- Select the tax year you’re filing and complete the form

- Review your Form, and make any necessary corrections.

- Transmit to the IRS

Get More Time to File 990-T with the IRS - Apply for a Tax Extension.

QSuppose your organization needs additional time to file Form 990-T or is uncertain about filing a completed form with zero errors. In that case, you can request an automatic extension of time using Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return.

Note - Even if your organization requests an extension with Form 8868, you will still need to pay any taxes due in full by the return’s original due date.

To file Form 8868, Visit, https://www.expresstaxexempt.com/e-file-form-8868/.